are hoa fees tax deductible in nj

Unfortunately homeowners association HOA fees paid on your personal residence are not deductible. You can deduct your property taxes paid or 15000 whichever is less.

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide

However if the home is a rental property HOA fees do become deductible.

. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. There isnt a limit on the amount of HOA fees you can deduct as a rental expense on Schedule E to offset your rental income. If the total amount of rented space is 10 then 10 of your HOA fees are tax deductible.

Do you pay HOA fees for condos or townhouses. Yeah we know thats not a great answer but its true. Every effort has been made to offer the most correct information possible.

That should make everything a little more clear to you and help keep you out of trouble with the IRS. Are HOA-fees deductible. A few common circumstances are listed below.

NJ Taxation The property tax deduction reduces your taxable income. For the most part no but there are exceptions. If the home is a rental property however HOA fees do become deductible.

It does this with the help of HOA dues fees that the association collects from members. Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an assessment by a private entity. File With Confidence Today.

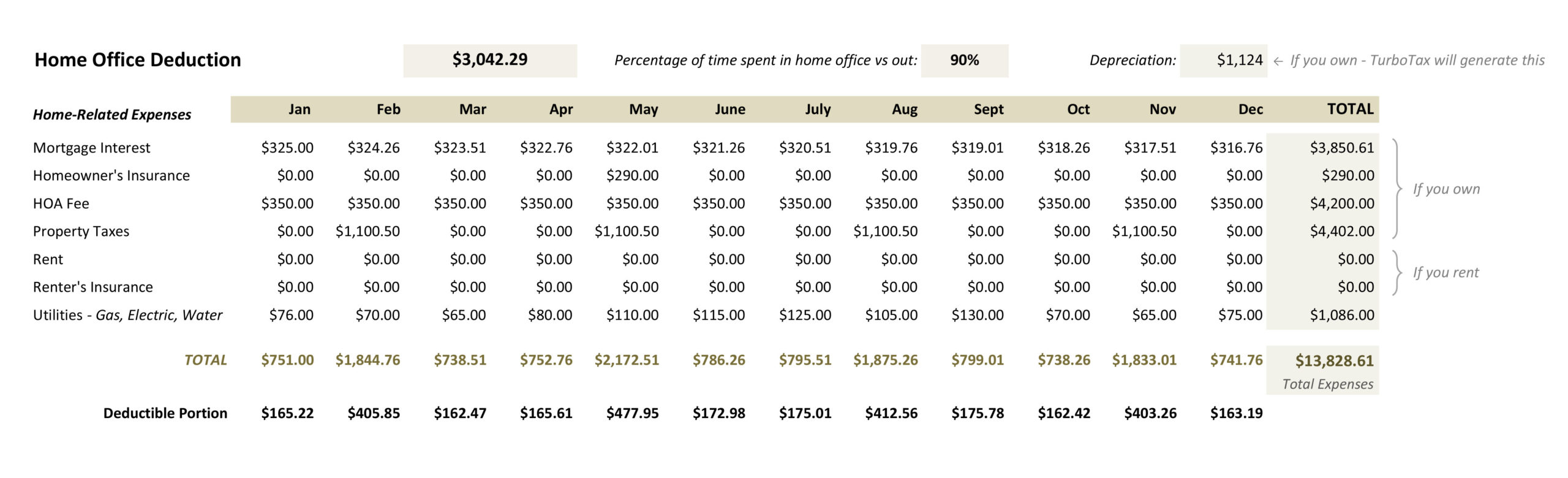

For Tax Years 2017 and earlier the maximum deduction was. The full amount of the HOA fee goes on line 21 of Form 8829 for your home office. Every homeowners association HOA is different but there are several situations in which you can deduct some or all of your HOA fees.

Where do HOA fees go on Schedule C. But there are some exceptions. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff. HOA fees are not deductible for your own home. To revoke an election requires the consent of IRS.

First though lets take a look at what an HOA is what they offer and what that can mean for you come April 15. Are HOA fees tax deductible Turbotax. There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual.

If you live in your property year-round then the HOA fees are not deductible. Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

More information is available on the creditdeduction. You can reach HOA fees tax deductible status if you rent out your property either year-round or for a specific portion of the year. How you use the property determines whether the HOA fee is tax-deductible or not.

Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees. You need to report HOA fees on your Schedule E form 1040 when you submit your tax return. If the property is a rental property HOA fees do become tax-deductible.

In this scenario the IRS sees these fees as property maintenance costs. The IRS may however allow you to deduct HOA fees if the property has been owned or rented out to another person. However you might not be able to deduct an HOA fee that covers a special assessment for improvements.

The answer is yes and no. Generally if you are a first time homebuyer your HOA fees will almost never be tax deductible. Tax Tips for New Jersey HOAs and Condo Associations.

If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. Secondly if you own an investment property you can deduct all HOA dues. You may be wondering whether this fee is tax deductible.

Are property taxes deductible in NJ. The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post.

Please know that to qualify for tax deductions of any type on rental property your property has to be rented out at least 15 days per year. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. Homeowners associations are allowed a 100 deduction on taxable income and a flat rate of 30 applied.

So lets go over when an HOA fee is tax deductible and when its not. An election to file Form 1120 H is done annually before its due date which is the 15 th day of the third month after a tax year. However if HOA fails to file Form 1120.

Because HOA fees are not deductible as a state or local tax the new 10000 limitation on state and local income taxes doesnt affect the deductibility of HOA fees. The HOA fee cannot be deducted from your taxes if you reside in your primary residence and must pay them on a monthly quarterly or annual basis. 2018 Tax Laws.

New for Tax Year 2022 The New Jersey College Affordability Act created three new income tax deductions for taxpayers with gross income under 200000. If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. In cases like these the IRS deems HOA fees to be a.

Answer Simple Questions About Your Life And We Do The Rest. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood. These fees are used to fund the associations maintenance and operations.

View solution in original post. This is Other Expenses for that form. Generally HOA dues are not tax deductible if you use your property as a home year-round.

What kind of taxes do you pay when you sell a house in New Jersey. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense.

Are Homeowners Association Fees Tax Deductible

10 Crestmont Rd Apt 7o Montclair Nj 07042 Realtor Com

10 Crestmont Road 1e Montclair Nj 07042 14 Photos Mls 3747054 Movoto

Tax Tips For Homeowners Nj Lenders Corp

135 Montgomery St 13 F 13 F Jersey City Nj 07302 20 Photos Mls 220002766 Movoto

What Hoa Costs Are Tax Deductible Aps Management

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

57 C2 Sandra Circle Unit C2 Westfield Town Nj 07090 Mls 3759043 Listing Information Long Foster

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Are Hoa Fees Tax Deductible Clark Simson Miller

320 South St Apt 1d Morristown Nj 07960 Realtor Com

Real Estate Or Stocks Which Is A Better Investment

7100 Blvd East 8c 8c Guttenberg Nj 07093 18 Photos Mls 220003000 Movoto

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller